Industry Forecast for POS Software in the UK

From the mid-20th century and all throughout the 21st century, the world is going through a drastic digital transformation. Ever since the emergence of computers in the 1950s, the conversion from analogue to digital, connectivity and data were the driving factors of this metamorphosis, continuing to the present day.

This global digitalization rang a bell for all kinds of merchants and consumers alike. While all industries in the world had to come up with innovative, tech-savvy solutions to keep up with the digital revolution, consumers also began to yearn for enhanced user experiences, quick services and unorthodox products, thanks to their access to information and knowledge.

A technical advancement that was able to transform many industries in a world struggling to keep up with digital transformation, is the development of POS systems. Initially, the POS system was nothing more than a cash drawer, which then evolved into a multi-purpose powerhouse of software which can handle all kinds of business processes from start to finish, regardless of the industry. The traditional POS system mainly facilitated quick payment facilities, reducing long queues at the cashier, but current POS systems offer far more diverse business solutions such as inventory management, sales tracking, employee and customer management, reporting and loyalty modules.

The adoption of POS software was fuelled by the increasing demand for POS terminals, which was a result of lifestyle changes and some policies set by the government. For example, the ‘Point of Sale VAT Retail Scheme’ set by the UK government requires retailers to include the relevant VAT calculations on their sales, and they use their POS systems to help configure the matrix.

The government sector is also adapting to POS solutions to tackle the challenges that arise when processing payments. This move towards reducing the administrative workload is also a reason for the surge in the sale of POS software, as well as the encouragement from the government for cashless payments.

Due to the COVID-19 pandemic, the UK faced severe economic setbacks, as did all the countries in the world. While the healthcare sector had to continue operating amid the crisis, businesses across hospitality, retail and other major industries had to go along with the government policies of temporary business shutdowns to mitigate the impact of the pandemic. Nationwide lockdowns and other restrictions imposed by the government further restricted the movement of people, leading to a severe revenue loss in the market of up to USD 19.39 billion in 2020. Due to the disruption of the supply chain and low consumer activity, the global POS market share witnessed a slight market decline of 1.1% in 2020 compared to the previous year.

However, amidst all the challenges that came up with the COVID-19 outbreak and its lasting impacts on the UK economy, the Point of Sale software market in the UK is expected double by 2028, under a Compound Annual Growth Rate (CAGR) of 8.1%, from USD 0.55 billion in 2021 to USD 1.05 billion in 2028. With the UK forecast for POS systems as such, the global Point of Sale market was valued at USD 22.08 billion in 2021, and is expected to reach USD 25.24 billion by the end of 2022, and to grow up to USD 70.75 billion by 2029 at a CAGR of 15.9%.

No matter how unprecedented and new the challenges brought by the pandemic outbreak have been, there are a few perks to be acknowledged in regard to the POS software market as well. Since the pandemic hastened the move towards a cashless economy in the UK, the call for POS software that facilitates cashless transactions points towards favourable market growth. Contactless consumer experiences which were a healthcare concern during the pandemic have also become a trend in the UK now, both as a sanitary precaution and a technology adaptation, further hinting at a flattering market growth.

Main Players in the UK POS Market

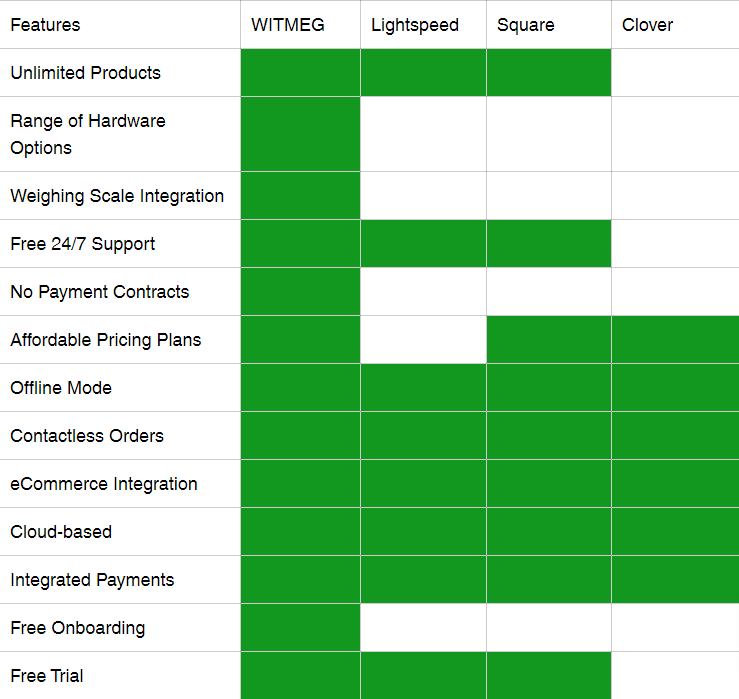

This rising demand for POS software in the market calls for a comparison between the main players in the market. Below, we provide a holistic view of the features offered by WITMEG, Lightspeed, Square and Clover, the main POS solution providers in the UK market today.

Features to Look Out for in a Good POS System

Reporting

With POS systems evolving with time and technology, they are much more than an exaggerated cash register. It is a data hub where every single detail related to the business gets automatically recorded, paving the way for data-driven decision-making.

Modern POS systems are so detail oriented that they collect data not only when a consumer purchases an item, but also when the simplest of actions are done, such as when an employee clock in or out for the day, a new item is added to the inventory and the cash drawer is opened. They also collect data from online purchases and other online activities as well, proving that there is no limit to the data that can be measured and collected through a high-capacity POS system.

However, with businesses running at their full speed towards ever-changing industry standards and having to take critical business decisions to stay ahead of the competition, a simple collection of raw data is not sufficient. The trick is implementing a POS system that can organise this plethora of raw data into digestible, customisable segments and display them in the form of comprehensive reports, using advanced reporting tools.

A feature worth having when it comes to the reporting tools offered by a POS system is online access. While legacy POS systems require you to be present on the premise to generate and access your reports, modern Cloud-based POS systems offer the functionality to access your reports any time, from wherever there is an active internet connection available.

The most trailblazing innovation related to POS reporting is mobile apps designed specifically for tracking business performance from the palm of one’s hand. Right now, several major POS providers in the market offer these apps as supplements to POS reporting suites, with the potential to become more advanced in the future.

The main types of reports that a good POS system has to offer are as follows.

- Sales Reports

- Payment Reports

- Employee Reports

- Inventory Reports

- Customer Reports

There can be so many different types of segmented reports under each of these categories, according to the capacity of the POS system. The ability to generate reports from the POS system is a must-have functionality for businesses of all shapes and sizes. They help business owners identify current sales trends, their top performing and low performing items, most commonly returned items, average order numbers during a given time period, total revenue, tax contribution, employee productivity, consumer trends and many more.

Integrated Payments

So many developments have happened during the time it took for POS systems to become powerhouses that guide businesses from the traditional cash registers they were before. They became smarter, safer and more streamlined to bring out the best in any business and have become the axis in most business ecosystems.

The most common word that comes to mind when talking about POS systems is payments. The era-defying requirement of any kind of business is accepting and processing payments for the products and services they offer, and this has evolved exponentially with time and technology. Modern POS systems now dominate the payment accepting process in any kind of business, offering more and more advanced, secure methods of payment for the benefit of both the merchant and the consumer.

Although when taken as two separate units, a POS system and an independent payment processor allow your business to boost its sales and reduce the queue at the cashier up to a certain amount, connecting the POS system and the payment processor together brings the ultimate benefit possible for your store. These are known as integrated payments.

By using a POS system which facilitates integrated payments, you get the utmost flexibility when processing payments. Since the POS system and the payment processor are aligned, data flows smoothly from one platform to the other leaving no rooms for mistakes and errors.

This is a must-needed facility for modern businesses which struggle to keep up with the growing number of consumers, long queues at the cashier and having a limited number of employees to man the counters. When integrated payments are facilitated on the POS system, it typically calculates the order total of each customer and automatically sends the amount to the payment processor.

Integrated payments are the vanguard of avoiding errors and mistakes when processing payments at the counter. Since it eliminates the need for manually entering the payment amount, it negates the risk of mis-keying mistakes. It also makes reporting and reconciliation efficient and easier because all transaction data from the card reader is automatically synced to the POS system at the end of the day.

Adapting integrated payments via a high-function POS system brings many benefits in the long term as well as in real time.

- More efficiency and productivity by being able to accommodate more customers

- Reduce human errors while processing payments

- Easy reporting and insights

- Effective time and cost management

eCommerce Integration

As a result of the world becoming smaller and more approachable due to technology and digitalization, consumers all around the world are always looking for something more than a conventional brick and mortar store for their shopping needs. Also, with the Coronavirus outbreak, people were confined to their homes, and an alternative method to run their stores became a vital factor for businesses in order to survive.

Almost every person above the age of 18 years in the world has access to the internet these days at least via a smartphone on their hand, so traditional shopping experiences that depended on consumers’ physical presence at a store are slowly ceasing. This is where the concept of eCommerce was introduced.

Basically put, an eCommerce store is the online version of a conventional brick-and-mortar store, which fully functions online. To make an eCommerce store successful, all the business processes that take place in a physical store such as inventory control, product browsing, discounts and promotions, customer experience enhancements, payment processing and after-sales services should be enabled in the online store as well.

When a business runs both physically and online, the perks are multitudinous. A study by Harvard Business Review found that customers spend 13% more in physical stores when they have conducted prior online research on the store’s webpage. Hence, it is imperative that stores have a streamlined process and uninterrupted communication between their online and offline stores.

A POS system with eCommerce Integration is the only way to achieve a smooth data flow and henceforth, a smooth business process, because it is a solution designed to build a streamlined connection between an online store and a POS system. With this function enabled, it can pull real-time data directly from the online platform and into the POS system, so that all the transaction details can be analysed as a whole.

Apart from the obvious, there are many advantages that come with eCommerce integration in a POS system. Followings are to name a few;

- Sell both physically and virtually at the same time and increase sales

- Avoid over-selling via real-time inventory tracking

- Eliminate the need for manually entering data

- Offer cross-channel promotions and discounts for customers

- Track consumer trends and learn more about customer behaviour

- Enhanced customer experience

Just like any relationship, proper communication is the key to success in any business. eCommerce integration makes sure that all the platforms involved in the business have proper communication, so that the business processes are run smoothly and efficiently.

Multi-location

Businesses are evolving into more and more complex enterprises every day and to keep up with the ever-growing customer numbers and demands, some businesses function in more than one location. This can be either in different cities, states, provinces or even in different countries.

Functioning in multiple locations always means more customers, more sales and more revenue, but the trick is to manage all of them all effectively without being overwhelmed. When everything from sales, customer service, inventory and revenue management, employee management flows from multiple locations, it is challenging to keep up with them all.

Enter multi location functionality with POS systems. With a POS system which has the multi location function enabled, business owners are able to achieve what is essentially a ‘bird’s eye view’ of all store locations and their moving parts.

Multi location functionality offered by POS systems takes care of the fact that you cannot be everywhere at all times. Here, the POS system serves as a centralised platform to manage all your business locations, gathering all the necessary data in one place and allowing you to view your business information from several locations as a whole.